Calculate home sale capital gains

The procedure to calculate the capital gains of inherited property is given below. Owning your home for more than a year means you pay the long-term capital gains tax.

3 Ways To Calculate Capital Gains Wikihow

Cost of the property The property did not cost anything to the inheritor but for calculation of capital gain the cost to the previous owner is.

. To calculate the gains or losses on a stock. If you sold your home for a profit your capital gains would be considered realized. Elaine is a single-filing taxpayer with an annual income of 100000.

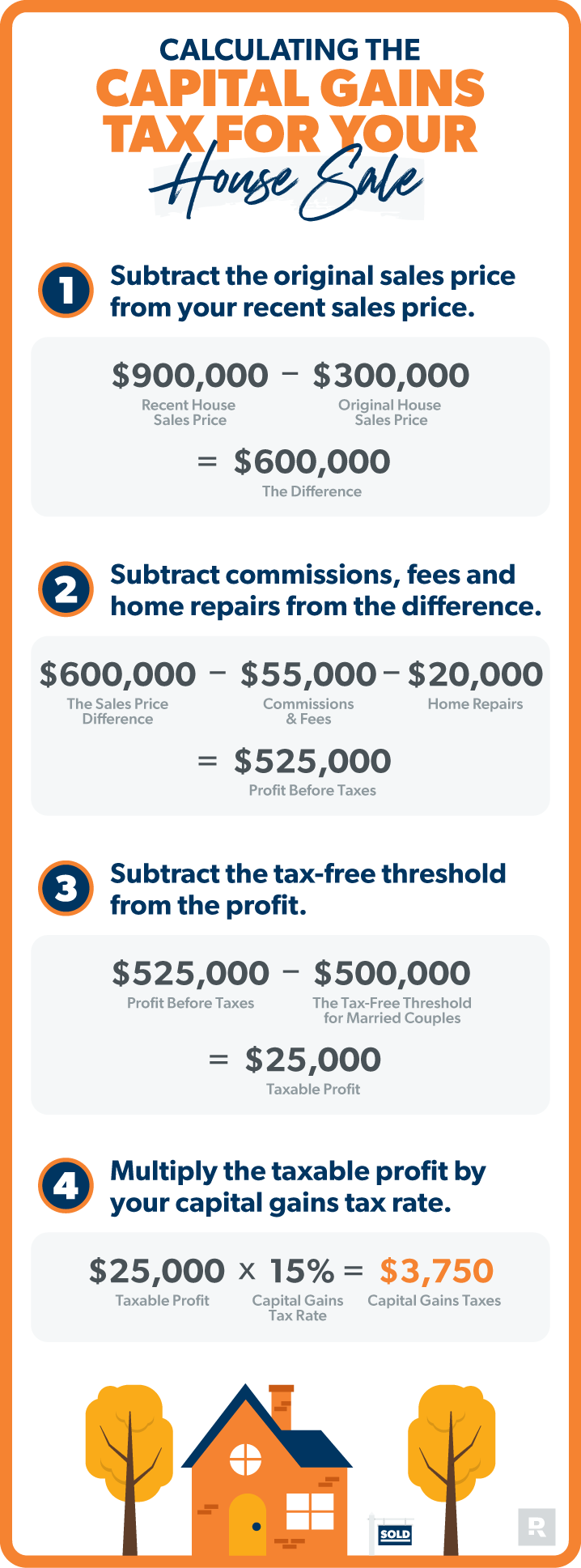

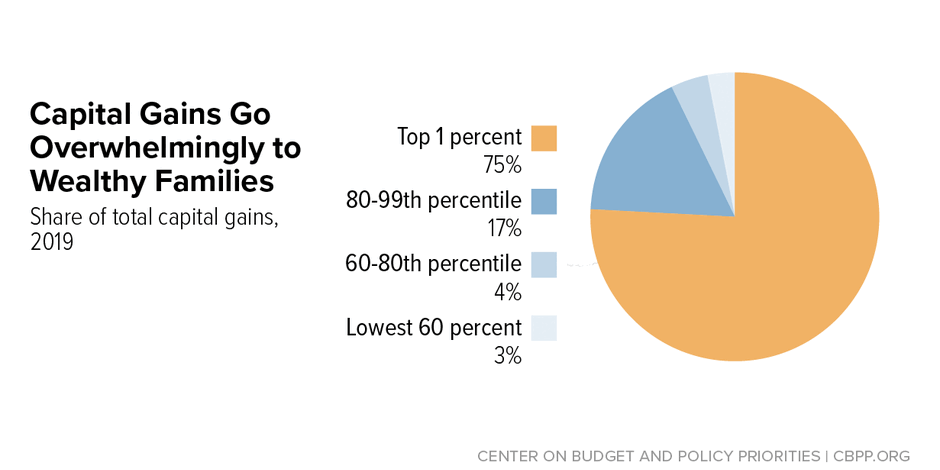

Capital gains are subject to a 15 tax or more depending on your income. Even the mention of these two words together can immediately conjure myths about owing the government 50 of the money earned from selling a home. Calculating capital gains tax on house sale in India.

You live in it for the first year rent the home for the next three years and when the tenants move out. The purchase price and the sale price represents the gain or loss per share. Unlike the seven short-term federal.

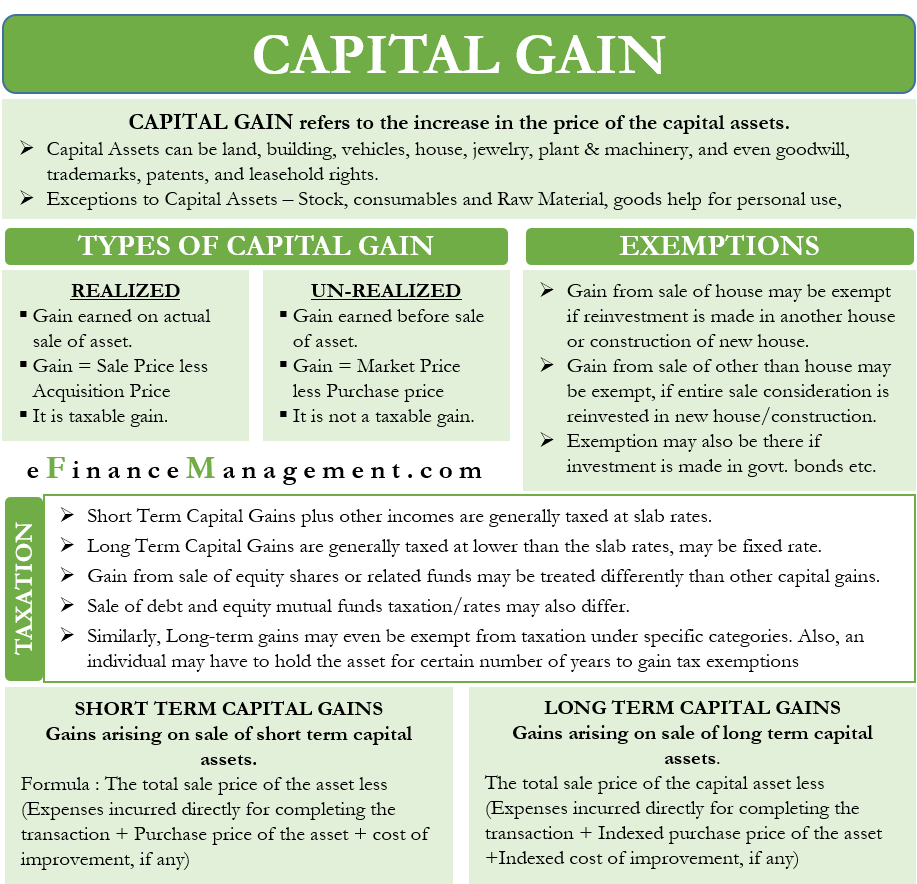

The capital gain will be treated as short term capital gain as he held the property for less than 36 months. How to calculate capital gains tax on the sale of property. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

Suppose you purchase a new condo for 300000. Using the example above lets calculate the capital gains taxes on Elaines investment property. Using the same.

Refer to Publication 523 Selling Your Home and Form 4797 Sales of Business Property for specifics on how to calculate and report the amount of gain. Capital gains are also subject to state taxes with the amount varying from state to state. You must know the cost of acquisition and indexation in order to calculate the capital gains.

Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria. Indexation Factor is the CII of the year of the sale divided by the CII of the year of purchase.

How Do You Calculate Capital Gains Tax. Capital gains refer to the increased value of an asset over time. If the asset decreases in value it is considered a capital loss.

This means the buyer is actually purchasing a bundle of assets the sellers business has owned rather than the entire business as an entity. The difference is your capital gain. Because she earns more than 78750 per year Elaine will be taxed on 15 percent of her total capital gain.

The IRS and many states assess capital gains taxes on the difference between what you pay for an asset your cost basis and what you sell it for your sale price. Additionally taxable gain on the sale may be subject to a 38 Net Investment Income Tax. Define capital gains.

When the asset is sold you compare the selling price with the original purchase price. Selling Assets that have Capital Gains in the Sale of a Business The vast majority of business are sold as asset sales rather than stock sales. And 2 you have not sold or exchanged another home during the two years preceding the sale.

This section of the Income Tax Act deals with exemptions availed on the sale of house property. More help with capital gains calculations and tax rates. Long-Term Capital Gains Tax.

How the Capital Gains Tax Works With Homes. For example where Mr. In Canada you only pay tax on 50 of any capital gains you realize.

Short-term capital gains are from assets that are held for less. Long Term. 1 You owned and lived in the home as your principal residence for two out of the last five years.

Then if you multiply that number by the 15 capital. For more information see Questions and Answers on the Net Investment Income Tax. Sam sold his property in January 2016 which he had purchased in May 2014 for Rs30 lakh.

In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. The exemption of two houses was introduced in the Budget 2019 prior to which the exemption was limited to 1 house. The capital gains obtained from this sale may be re-invested into buying or constructing up to two other house properties.

Now that we know how capital gains are calculated when you sell your home lets look at how those capital gains are taxed. After 2 years youll qualify for the personal exemption more on that below.

Capital Gains Tax What Is It When Do You Pay It

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

3 Ways To Calculate Capital Gains Wikihow

How Capital Gains Affect Your Taxes H R Block

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax 101

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Meaning Types Taxation Calculation Exemptions

3 Ways To Calculate Capital Gains Wikihow

Yes You Can Avoid Real Estate Capital Gains Taxes Here S How

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How Much Tax Will I Pay If I Flip A House New Silver

How To Save Capital Gain Tax On Sale Of Residential Property

State Taxes On Capital Gains Center On Budget And Policy Priorities

3 Ways To Calculate Capital Gains Wikihow

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

3 Ways To Calculate Capital Gains Wikihow